capital gains tax canada crypto

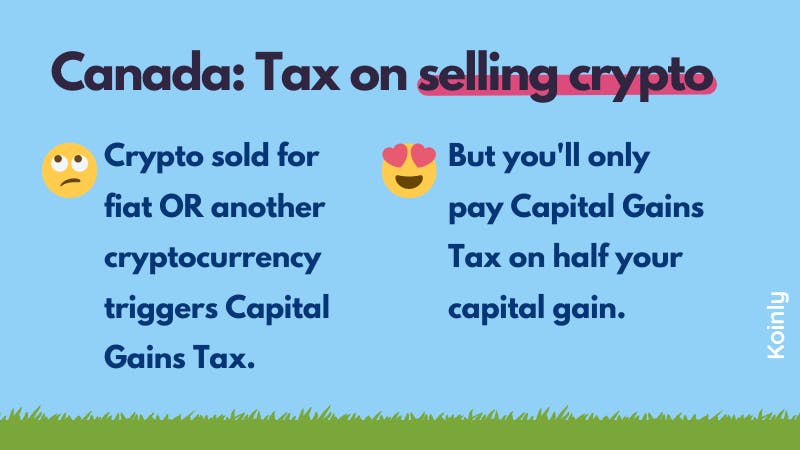

However just as only 50 of capital gains are taxed only 50 of capital losses can be deducted. Is there capital gains tax on crypto.

What Is Cryptocurrency How Does Crypto Impact Taxes H R Block

Calculating Capital Gain Tax.

. 1 week ago Jul 05 2022 If you earned a capital gain of 10000 on an investment 5000 of that is taxable. If youre having a tough time determining whether your transactions are crypto capital gains in Canada or business income the CRA has information available to help you. While many countries including the US have special tax rates for capital gains.

If the sale of a cryptocurrency does not constitute carrying on a business and the amount it sells for is more than the original purchase price or its adjusted cost base then the taxpayer has. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. The IRS generally treats gains on cryptocurrency the same way it treats any kind of capital gain.

The amount of tax you pay on crypto in Canada depends on whether you are considered to be operating a crypto business or simply trading crypto for capital gains. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. A simplified scenario where you would pay Capital Gain Tax is this.

How Capital Gains Tax Works In Canada Forbes Advisor. When it comes time to file your capital gains taxes youll have. How is crypto tax calculated in Canada.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more. The CRA makes it clear that crypto is subject to either Income Tax or Capital Gains Tax - depending on whether youre seen to be conducting business-like activities or acting as an.

A tax on 50 percent of the profits is imposed in case of a. Taxes on cryptocurrencies are considered as either capital gains tax or as income tax in Canada. How Much Is Capital Gains Tax On Crypto In most jurisdictions capital gains taxes range between 10-40 for short term capital gains under a few years and 0-10 for long-term.

With 247 trading and investment minimums as low as 10 its so easy to get started. If you are reporting your crypto transactions as business income you will need to fill out form T2125 with your tax return. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian Tax.

If you started off with 5000 of crypto at the beginning of the year and by the. Ad Make Tax-Smart Investing Part of Your Tax Planning. The crypto tax in Canada directly depends on your income capital gains capital losses potential deductibles and your state of residence.

Valuing cryptocurrency as inventory. If you are reporting them as capital gains you need to fill out the. Interestingly only half of your capital gains are taxable.

However it is important to note that only 50 of your capital gains are taxable. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. Connect With a Fidelity Advisor Today.

Generally you only have to pay. So for example if you realize a gain of 10000 on selling a few Bitcoins youll only pay capital gains taxes on 5000. Crypto tax rates range from 0 to 37 depending on several factors including whether your cryptocurrency is taxed as ordinary income short-term capital gains or long-term.

A capital gain or loss is realized when a crypto asset is purchased as a capital investment and later disposed of. That is youll pay ordinary tax. In addition you should be aware of the superficial loss rule which means you.

How Much Tax Is Imposed On Cryptocurrency In Different Countries Worldwide Technology News

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Cryptocurrency Tax Calculator Forbes Advisor

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Colombia And Cryptocurrency Blockchain And Cryptocurrency Laws Regulations

![]()

Cryptocurrency Taxes In Canada Cointracker

Ethereum Eth Cryptocurrency Coins Poster In 2022 Poster Cryptocurrency Vector Art

Must Know Crypto Laws In Canada For Bitcoin Investors Your Taxes Identity And Transaction Records Youtube

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger

How To Cash Out Crypto Without Paying Taxes In Canada Sep 2022 Yore Oyster

The Crypto Tax Nightmare Facing New Traders

Unocoin Wallets Users Can Buy Bitcoins Using Payumoney Wallets Cryptocurrency Bitcoin Price Bitcoin Mining

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Crash Is Now The Time To Buy The Dip Forbes Advisor India

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Taxation 7 Things You Should Know Metrics Chartered Professional Accounting

How Is Cryptocurrency Taxed Here S What You Need To Know Kiplinger