boulder co sales tax efile

Sales and Use TaxFinancial Services. This tax must be collected in addition to any applicable city and state taxes.

Colorado Sales Tax Guide And Calculator 2022 Taxjar

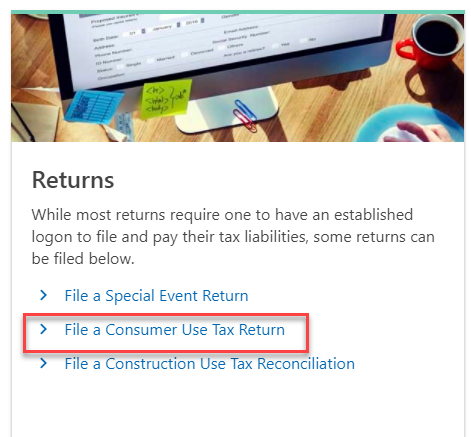

Consumer Use Tax How To File Online Department Of Revenue Taxation.

. Open Space Tax 2012 - Ordinance No. There are a few ways to e-file sales tax returns. The university is exempt from paying sales tax on purchases from its own departments such as Internal Service Centers.

Please visit the Colorado Department of Revenue website for more information or for required forms. Sales and Use Tax 2011 - Ordinance No. Boulder County Sales Taxes.

Businesses that pay more than 75000 per year in state sales tax. The Boulder County sales tax rate is. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now.

Non-profit human service agencies. The minimum combined 2022 sales tax rate for Boulder County Colorado is. Colorado Tax Lookup Tool.

PdfFiller allows users to edit sign fill and share all type of documents online. For subsequent sales tax deadlines affected taxpayers are encouraged to either file zero returns close a location or to close their accounts through Revenue Online. 2055 lower than the maximum sales tax in CO.

You may also contact them via phone. Sales tax returns must be filed monthly. The Colorado sales tax rate is currently.

Of a permitted construction project to determine whether there was an overpayment or underpayment of Construction Use Tax. In the example below the full tax rate has been assessed by the vendor and no additional use tax is due. For tax rates in other cities see Colorado sales.

Property Data. Historic Preservation Tax 2009 - Ordinance No. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

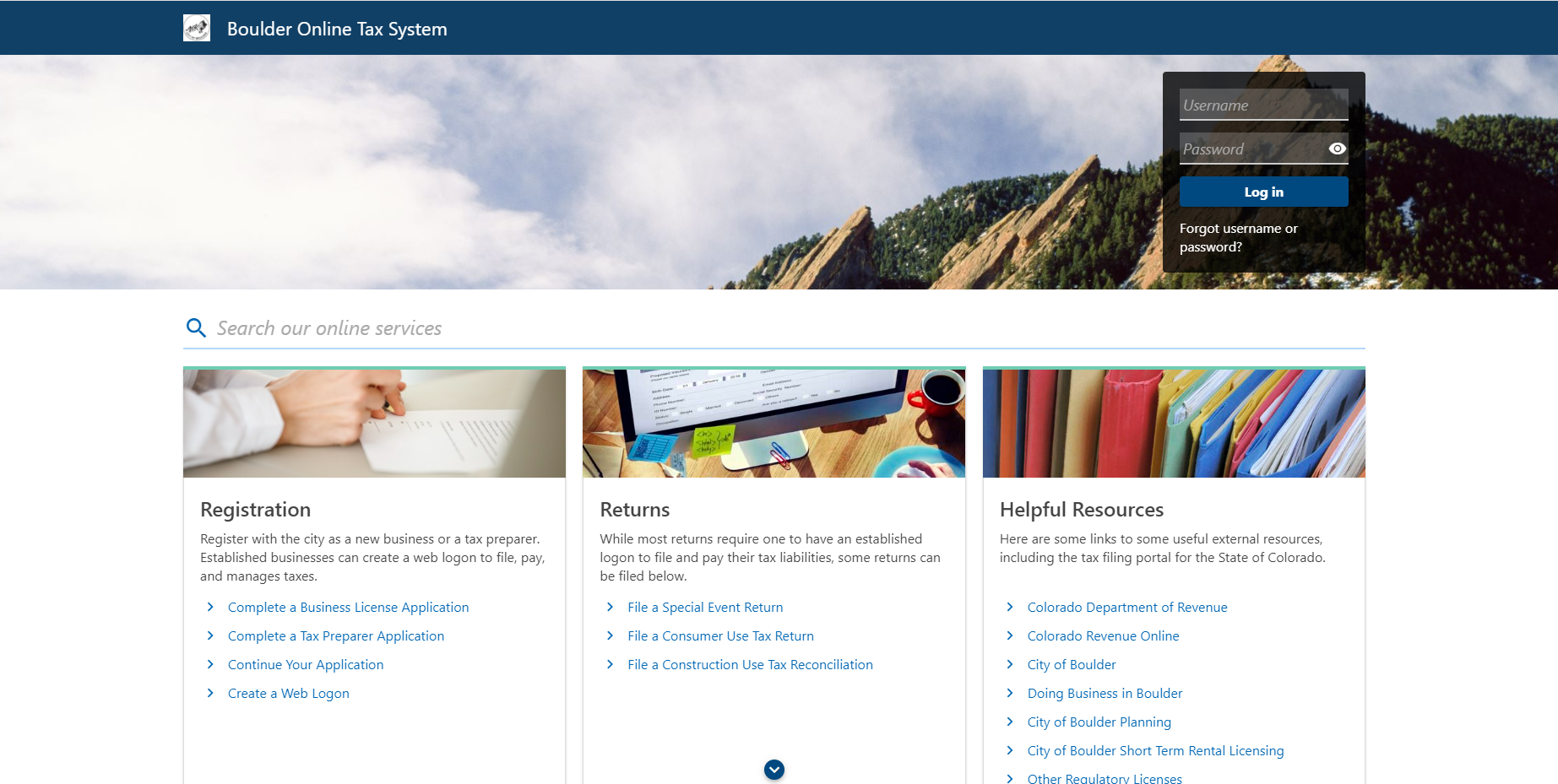

In 2001 the voters of Boulder County passed a ballot issue that allowed for a 01 percent one cent on a 10 purchase countywide transportation sales tax. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. Construction Use Tax is the salesuse tax paid by contractors or homeowners for construction materials used when erecting building remodeling or repairing real property.

The 2018 United States Supreme Court decision in South Dakota v. Consumer Use Tax 2011 - Ordinance No. As a statutory Town the Town of Eries sales tax is collected by the State of Colorado.

Boulder County does not have a sales tax licensing requirement as our sales tax is collected by the Colorado Department of Revenue. Businesses located in the Center Fee districts sales tax rate is 175 and is in addition to the district fees. File Business Sales Tax information registration support.

10 rows Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of. There is no provision for any po rtion to be retained as a vendor fee. Boulder Countys tax rate is 0985.

Sales and Use Tax 2002 - Ordinance No. The Boulder sales tax rate is. Jail improvements and operation.

Filing of the return is required for all. The minimum combined 2022 sales tax rate for Boulder Colorado is. You can print a 8845 sales tax table here.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Total Boulder County tax rate. Colorado Department of Revenue.

Sales and Use Tax 2017 - Ordinance No. The January 20 2022 deadline for sales tax monthly quarterly or annual is extended until May 20 2022. If you have more than one business location you must file a separate return in Revenue Online for each location.

This is the total of state county and city sales tax rates. The County sales tax rate is. Please keep in mind that a City of Boulder Business License comes with a tax filing requirement.

The City of Lovelands sales tax rate is 30 combined with Latimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. Ad New State Sales Tax Registration. File online tax returns with electronic payment options.

Check those invoices and receipts to ensure that the full tax rate City County RTD State of 8845 has been assessed and collected. Saturday May 7 2022. This is the total of state and county sales tax rates.

The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. What is the sales tax rate in Boulder County. Sent direct messages to Sales Tax Staff.

Monthly returns are due the 20th day of month following reporting period. In 2007 voters approved an extension of the sales tax through 2024. If only County RTD and State taxes 4985 were collected then the City use tax rate of 386 is due.

Boulder County enacts Stage 1 fire restrictions News release. Kailee Nicole Foerster 2338 14th Street Unit 2 Boulder CO 80304 949-409-5911. It is the practice of CU Boulder to assume that the item or product being sold is taxable unless specifically excluded by statute.

However students faculty and staff not acting in their capacity as agents of the university private companies and the public must. Complete a Business License application or register for a Special Event License. 300 or more per month.

For additional e-file options for businesses with more than one location see Using an. Boulder co sales tax efile. The Transportation Sales Tax helps fund.

Higher sales tax than 89 of Colorado localities. Economic Nexus requires remote sellers with no physical nexus in Boulder to collect and remit sales tax on retail sales of tangible personal property commodities andor services. There is always a tax filing requirement even if tax due is 0.

County road and transit improvements. Taxpayers are encouraged to use Revenue Online to file sales tax rather than the Sales and Use Tax System. Online Sales Tax Filing.

The Colorado state sales tax rate is currently.

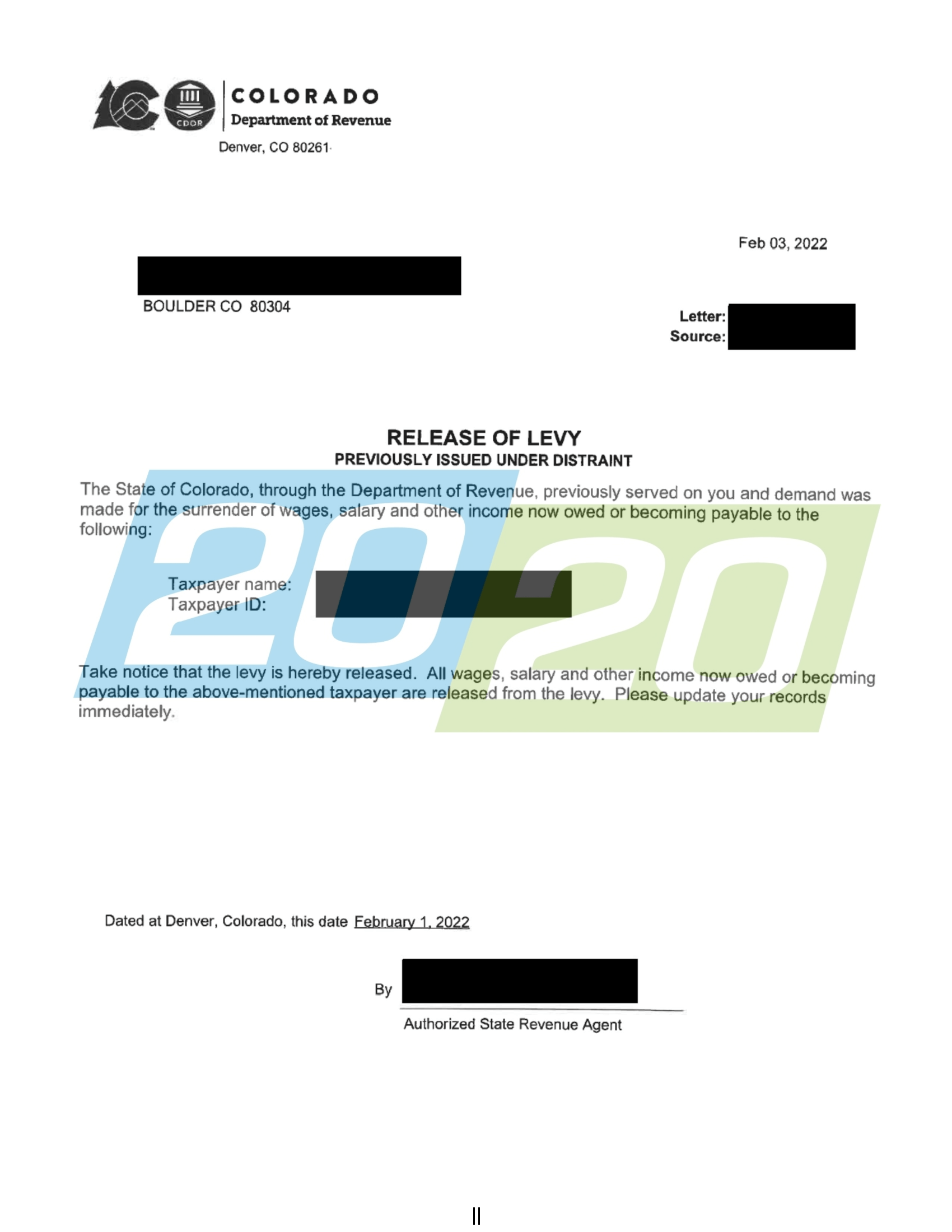

Tax Resolutions In Colorado 20 20 Tax Resolution

Sales And Use Tax City Of Boulder

Polis Legislators Announce One Time Tax Refund To Coloradans By Late Summer

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Construction Use Tax City Of Boulder

Tax Resolutions In Colorado 20 20 Tax Resolution

Sales Tax Campus Controller S Office University Of Colorado Boulder

Tax Accountant For U S Expats International Taxpayers Us Tax Help

Taxes In Boulder The State Of Colorado

Sales Tax Campus Controller S Office University Of Colorado Boulder

Tax Deadline Colorado Department Of Revenue Extends Income Tax Payment And Filing Deadline For Much Needed Relief

Boulder Online Tax System Help Center City Of Boulder

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Campus Controller S Office University Of Colorado Boulder

Breckenridge Golf Course Wedding Breckenridge Colorado Wedding Distinctive Mountain Events Breckenridge Wedding Golf Course Wedding Wedding Ceremony Arch